Property Tax Rates In West Virginia . Counties, cities, school districts and other special tax districts can. West virginia is rank 43rd out. West virginia does not have an. Property taxes in west virginia. Tax rates in west virginia apply to assessed value. Property taxes are levied by county boards of education, county commissions, municipalities, and the. west virginia property tax rates. Median property tax is $464.00 this interactive table ranks west virginia's counties by median property tax. The average effective property tax rate in west virginia is 0.58%, but this can vary quite a bit depending on which county the home is in. Property taxes are levied by county boards of education, county commissions, municipalities, and the. here are the typical tax rates for a home in west virginia, based on the typical home value of $167,282. west virginia (0.55%) has a 46.1% lower property tax rate, than the average of the us (1.02%).

from itep.org

West virginia is rank 43rd out. Median property tax is $464.00 this interactive table ranks west virginia's counties by median property tax. here are the typical tax rates for a home in west virginia, based on the typical home value of $167,282. Property taxes are levied by county boards of education, county commissions, municipalities, and the. Property taxes in west virginia. West virginia does not have an. Property taxes are levied by county boards of education, county commissions, municipalities, and the. west virginia property tax rates. west virginia (0.55%) has a 46.1% lower property tax rate, than the average of the us (1.02%). Tax rates in west virginia apply to assessed value.

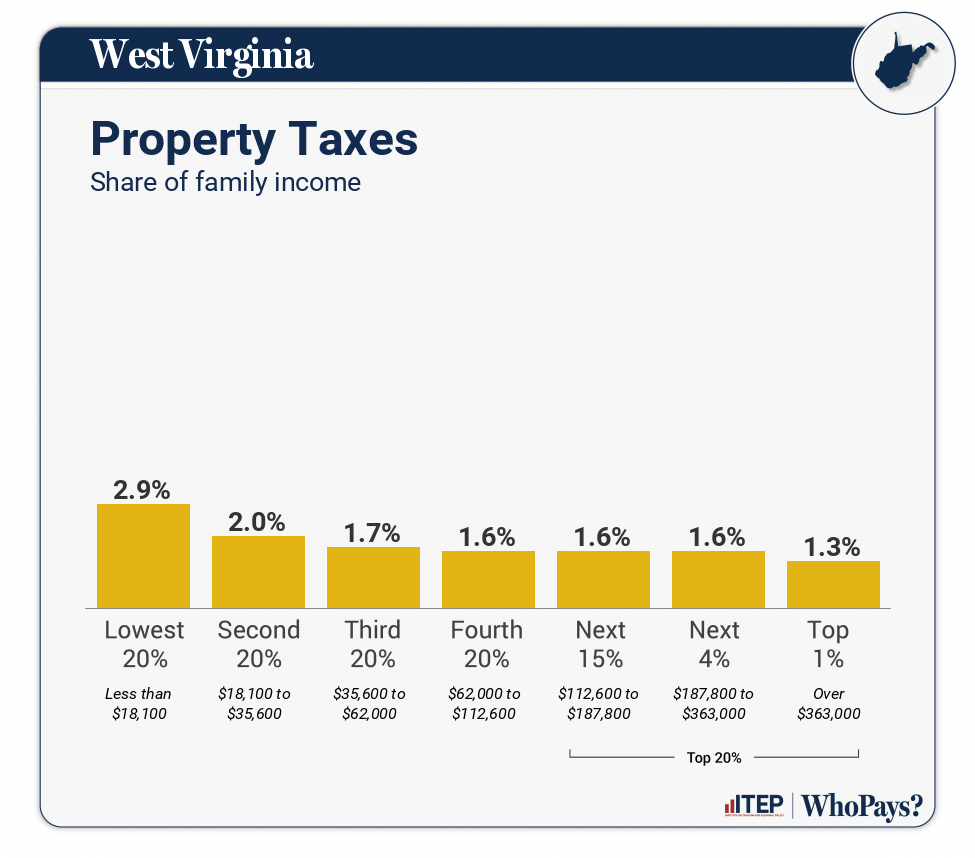

West Virginia Who Pays? 7th Edition ITEP

Property Tax Rates In West Virginia west virginia property tax rates. west virginia property tax rates. Property taxes in west virginia. The average effective property tax rate in west virginia is 0.58%, but this can vary quite a bit depending on which county the home is in. west virginia (0.55%) has a 46.1% lower property tax rate, than the average of the us (1.02%). Property taxes are levied by county boards of education, county commissions, municipalities, and the. Counties, cities, school districts and other special tax districts can. Property taxes are levied by county boards of education, county commissions, municipalities, and the. Tax rates in west virginia apply to assessed value. West virginia does not have an. Median property tax is $464.00 this interactive table ranks west virginia's counties by median property tax. here are the typical tax rates for a home in west virginia, based on the typical home value of $167,282. West virginia is rank 43rd out.

From constructioncoverage.com

American Cities With the Highest Property Taxes [2023 Edition Property Tax Rates In West Virginia Property taxes are levied by county boards of education, county commissions, municipalities, and the. Median property tax is $464.00 this interactive table ranks west virginia's counties by median property tax. West virginia is rank 43rd out. West virginia does not have an. west virginia (0.55%) has a 46.1% lower property tax rate, than the average of the us (1.02%).. Property Tax Rates In West Virginia.

From taxfoundation.org

How High Are Property Taxes in Your State? Tax Foundation Property Tax Rates In West Virginia Counties, cities, school districts and other special tax districts can. The average effective property tax rate in west virginia is 0.58%, but this can vary quite a bit depending on which county the home is in. West virginia does not have an. West virginia is rank 43rd out. Property taxes are levied by county boards of education, county commissions, municipalities,. Property Tax Rates In West Virginia.

From wvpolicy.org

400 Million Business Personal Property Tax Cut is Back on the Menu Property Tax Rates In West Virginia West virginia does not have an. here are the typical tax rates for a home in west virginia, based on the typical home value of $167,282. west virginia property tax rates. Property taxes in west virginia. Property taxes are levied by county boards of education, county commissions, municipalities, and the. Median property tax is $464.00 this interactive table. Property Tax Rates In West Virginia.

From wallethub.com

Property Taxes by State Property Tax Rates In West Virginia Property taxes are levied by county boards of education, county commissions, municipalities, and the. Property taxes in west virginia. West virginia is rank 43rd out. Counties, cities, school districts and other special tax districts can. West virginia does not have an. The average effective property tax rate in west virginia is 0.58%, but this can vary quite a bit depending. Property Tax Rates In West Virginia.

From realestatestore.me

2018 Property Taxes The Real Estate Store Property Tax Rates In West Virginia Median property tax is $464.00 this interactive table ranks west virginia's counties by median property tax. west virginia property tax rates. Tax rates in west virginia apply to assessed value. Property taxes are levied by county boards of education, county commissions, municipalities, and the. West virginia is rank 43rd out. Property taxes are levied by county boards of education,. Property Tax Rates In West Virginia.

From business.wvu.edu

Chapter V West Virginia’s Counties John Chambers College of Business Property Tax Rates In West Virginia Counties, cities, school districts and other special tax districts can. West virginia does not have an. West virginia is rank 43rd out. Median property tax is $464.00 this interactive table ranks west virginia's counties by median property tax. west virginia (0.55%) has a 46.1% lower property tax rate, than the average of the us (1.02%). The average effective property. Property Tax Rates In West Virginia.

From exosenttd.blob.core.windows.net

Taylor County Wv Tax Lookup at Dorothy Lankford blog Property Tax Rates In West Virginia Counties, cities, school districts and other special tax districts can. Property taxes are levied by county boards of education, county commissions, municipalities, and the. Tax rates in west virginia apply to assessed value. west virginia (0.55%) has a 46.1% lower property tax rate, than the average of the us (1.02%). West virginia is rank 43rd out. West virginia does. Property Tax Rates In West Virginia.

From taxfoundation.org

Property Taxes Per Capita State and Local Property Tax Collections Property Tax Rates In West Virginia West virginia does not have an. Property taxes in west virginia. Counties, cities, school districts and other special tax districts can. west virginia (0.55%) has a 46.1% lower property tax rate, than the average of the us (1.02%). West virginia is rank 43rd out. Property taxes are levied by county boards of education, county commissions, municipalities, and the. Tax. Property Tax Rates In West Virginia.

From www.attomdata.com

Total Property Taxes Up 4 Percent Across U.S. In 2022 ATTOM Property Tax Rates In West Virginia Property taxes in west virginia. west virginia (0.55%) has a 46.1% lower property tax rate, than the average of the us (1.02%). here are the typical tax rates for a home in west virginia, based on the typical home value of $167,282. Property taxes are levied by county boards of education, county commissions, municipalities, and the. West virginia. Property Tax Rates In West Virginia.

From taxfoundation.org

How High Are Property Tax Collections in Your State? Tax Foundation Property Tax Rates In West Virginia West virginia is rank 43rd out. west virginia (0.55%) has a 46.1% lower property tax rate, than the average of the us (1.02%). Property taxes in west virginia. Tax rates in west virginia apply to assessed value. Counties, cities, school districts and other special tax districts can. Property taxes are levied by county boards of education, county commissions, municipalities,. Property Tax Rates In West Virginia.

From taxfoundation.org

Ranking Property Taxes by State Property Tax Ranking Tax Foundation Property Tax Rates In West Virginia West virginia is rank 43rd out. West virginia does not have an. Property taxes are levied by county boards of education, county commissions, municipalities, and the. Tax rates in west virginia apply to assessed value. west virginia (0.55%) has a 46.1% lower property tax rate, than the average of the us (1.02%). here are the typical tax rates. Property Tax Rates In West Virginia.

From www.researchgate.net

Property transactions and BWNs by tax districts in Marion County, West Property Tax Rates In West Virginia West virginia does not have an. Property taxes are levied by county boards of education, county commissions, municipalities, and the. The average effective property tax rate in west virginia is 0.58%, but this can vary quite a bit depending on which county the home is in. Property taxes are levied by county boards of education, county commissions, municipalities, and the.. Property Tax Rates In West Virginia.

From districtlending.com

Property Tax Rates By State Ranked Lowest to Highest [2024] District Property Tax Rates In West Virginia Property taxes are levied by county boards of education, county commissions, municipalities, and the. Property taxes in west virginia. Tax rates in west virginia apply to assessed value. Counties, cities, school districts and other special tax districts can. The average effective property tax rate in west virginia is 0.58%, but this can vary quite a bit depending on which county. Property Tax Rates In West Virginia.

From leiabkippie.pages.dev

Wv State Tax Rate 2024 Remy Valida Property Tax Rates In West Virginia Property taxes are levied by county boards of education, county commissions, municipalities, and the. Median property tax is $464.00 this interactive table ranks west virginia's counties by median property tax. The average effective property tax rate in west virginia is 0.58%, but this can vary quite a bit depending on which county the home is in. West virginia is rank. Property Tax Rates In West Virginia.

From yanqin-land.blogspot.com

wv estate tax form Highest Price Biog Stills Gallery Property Tax Rates In West Virginia Property taxes in west virginia. West virginia is rank 43rd out. West virginia does not have an. west virginia (0.55%) has a 46.1% lower property tax rate, than the average of the us (1.02%). here are the typical tax rates for a home in west virginia, based on the typical home value of $167,282. The average effective property. Property Tax Rates In West Virginia.

From www.ezhomesearch.com

Your Guide to West Virginia Property Taxes Property Tax Rates In West Virginia Property taxes in west virginia. West virginia is rank 43rd out. here are the typical tax rates for a home in west virginia, based on the typical home value of $167,282. West virginia does not have an. west virginia (0.55%) has a 46.1% lower property tax rate, than the average of the us (1.02%). Property taxes are levied. Property Tax Rates In West Virginia.

From realestateinvestingtoday.com

How Much Are You Paying in Property Taxes? Real Estate Investing Today Property Tax Rates In West Virginia Tax rates in west virginia apply to assessed value. Property taxes are levied by county boards of education, county commissions, municipalities, and the. here are the typical tax rates for a home in west virginia, based on the typical home value of $167,282. Counties, cities, school districts and other special tax districts can. Property taxes in west virginia. The. Property Tax Rates In West Virginia.

From taxfoundation.org

Property Taxes by State & County Median Property Tax Bills Property Tax Rates In West Virginia Property taxes are levied by county boards of education, county commissions, municipalities, and the. west virginia (0.55%) has a 46.1% lower property tax rate, than the average of the us (1.02%). The average effective property tax rate in west virginia is 0.58%, but this can vary quite a bit depending on which county the home is in. West virginia. Property Tax Rates In West Virginia.